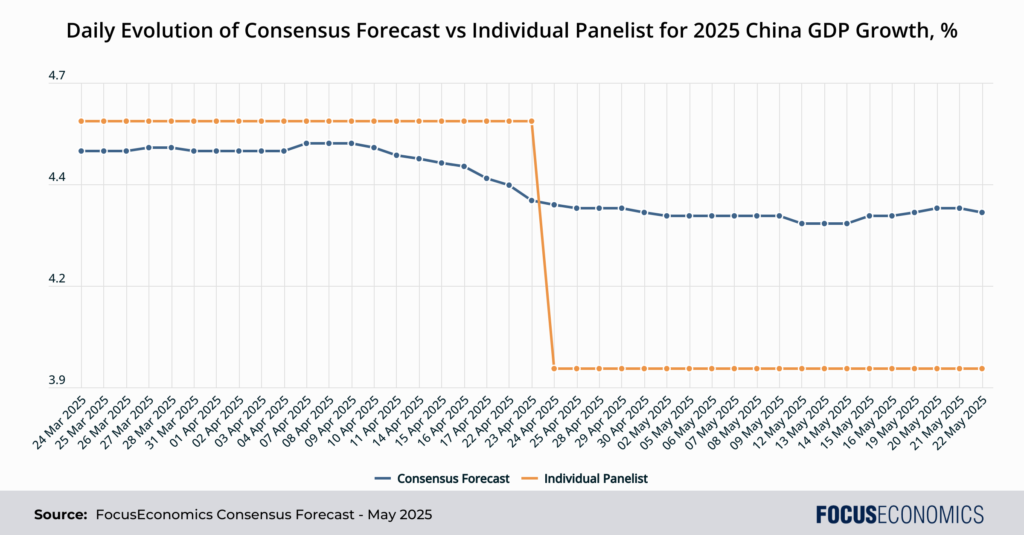

It came sooner than expected. In May, China agreed to a trade ceasefire with the U.S., and will now face an average U.S. tariff of 51% instead of 127%. As can be seen below, that’s already leading economists to redraw their forecasts for the Chinese economy.

As we outlined in last month’s newsletter, agility is now more important than ever when it comes to forecasting the world economy. Economists need to be both quick and accurate.

In line with this, we recently began offering Daily Updates to our Consensus Forecasts. Available via our data platform, they track the latest market projections for 198 economies and 39 commodities every day. Our panelists including leading banks such as ING, JPMorgan and Goldman Sachs, and top research institutions like the Economist Intelligence Unit and Oxford Economics.

China’s outlook has brightened somewhat:

After Trump announced reciprocal tariffs on 2 April, our panelists were quick to update their forecasts for China’s GDP growth this year, as can be seen from the above graph. At 4.3%, the GDP growth rate projected just before the 90-day tariff pause would have been the third-weakest since 1990.

Since China and the U.S. agreed to the 90-day pause, our Consensus Forecast for China’s GDP growth this year has increased, for reasons explained by analysts at ING:

“In our view, the reduction of tariffs on China […] is a sufficient enough reduction to allow for a more or less return of normal trade – at this level, we suspect exporters, importers, and consumers will share in absorbing the impact of the tariffs, and overall business will likely resume.”

That said, not all the panelists we poll as part of our Consensus Forecast have adjusted their forecasts given the high level of uncertainty, as is the case with the Economist Intelligence Unit:

“We maintain that US GDP will slip into a mild recession in 2025 even as the pause forestalls a deeper downturn. The de-escalation will create upside risk for our China growth forecast (currently at 4.4%) through a rosier export outlook in May-July, although considerable uncertainties will remain a deterrent to business investments, similar to the situation in the US.”

This highlights the value of our Consensus Forecasts to offer economic projections that are not just quick—available on a daily basis—but also accurate. By averaging the forecasts of leading economists, our Consensus Forecasts provide a balanced view of future economic conditions:

On our data platform, you can also view how the forecasts of our individual panelists have evolved, comparing them with other panelists and our Consensus. This allows both a zoomed-out and zoomed-in view of China’s economy:

More insight from our panel of analysts on China’s economic outlook:

Analysts at Goldman Sachs said:

“We had assumed that the US-China trade talks in Geneva would reduce tariff rates on Chinese products from >100% to 50-60%. The joint announcement released on Monday (May 12) indicated larger-than-expected tariff rollbacks, with US tariffs on Chinese goods dropping to 30% for 90 days. Although the forward path of tariffs remains uncertain, we now expect Chinese real exports to be roughly flat in 2025/26 (vs. -5% per year previously). We raise our real GDP growth forecast to 4.6% in 2025 and 3.8% in 2026 (vs. 4.0% and 3.5%, respectively, previously).”

S&P Global Ratings economists commented:

“For China, the mutual tariff reduction is a relief for exporters and the economy generally. After the significant downward revision of our growth outlook for China during our recent update, the more benign tariff outlook should bring the growth outlook closer to our March forecast of 4.1% growth in 2025 and 3.8% in 2026.”

Get a Free Trial of our Daily Forecast Updates!

React quickly to changes in your target markets and global economic developments with our comprehensive and agile coverage. Delivery via FocusAnalytics dashboards, data exports or our API solutions. Start your free trial today!